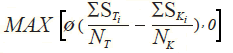

It stands for double average rate option; a double average option in which the strike price is not set at the time of trade. Instead, the strike price is calculated as the average rate recorded at a series of points over the option’s life. It follows that the option’s payoff is the positive difference between the arithmetic average of the underlying spot prices at selected points (samples) in an observation period and the arithmetic average of the strike prices. If the difference is zero or negative, there is no payoff. Mathematically, the option’s payoff is given by the following formula:

Comments