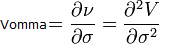

An option sensitivity measure (a second-order greek) that captures the second order sensitivity of an option to the volatility of its underlying. Vomma is the second derivative of the option price with respect to volatility. In other words, vomma measures the rate of change of vega due to change in volatility (implied volatility). The following formula defines vomma:

Vomma is positive for options not in the money, and generally increases as the option gets deeper out-of-the-money. However, it decreases when vega drops. A positive vomma means a position will become “long vega” as implied volatility increases and short vega otherwise.

Vomma is alternatively known as volga, vega gamma, or vega convexity.

Comments